Whilst the exemptions are relatively straight forward, applying them is more complex and can also involve understanding the separate regulations that apply to both Energy Performance Certificates and the Minimum Energy Efficiency Standards. There are some organisations suggesting that landlords can easily avoid improving their buildings by claiming an exemption. Our experience is that this is more difficult than it first appears and could easily cost more than improving the building to meet the standards.

Exempt buildings and tenancies

Not all buildings and tenancies fall within The Energy Efficiency (Private Rental Property) (England and Wales) Regulations 2015. The MEES do not apply to:

- Buildings that have not been legally required to have an EPC. These can include some listed buildings (see our specific notes on this topic), temporary properties, some HMOs and holidays lets. It will also apply if the property has not been built, sold, let or significantly altered since the introduction of EPCs.

- Buildings without a valid EPC. This would include buildings where the EPC is over ten years old when it is relied upon for the MEES regulations.

- Buildings only with a voluntary EPC. An EPC may have been lodged for any number of reasons. EPCs completed for purposes other than the construction, sale, let or significant alteration of the building, including those lodged in a mistaken understanding that one was required, are known as voluntary EPCs. A building is only subject to MEES if the EPC was legally required. NB: There is currently no way to tell this from the EPC itself and so you will need to know the history of whether or not the building has legally required an EPC.

- Buildings occupied solely under licence. MEES only applies to buildings occupied under a “Relevant Tenancy”. This includes an assured tenancy, a regulated tenancy and domestic agricultural tenancies. If the occupier is present only under a licence to occupy the MEES requirements will not apply as there is no tenancy.

- Social housing schemes. The regulations apply only to privately rented properties. Social housing is exempt from MEES regardless of its condition, quality, or EPC rating.

Exemptions from making improvements

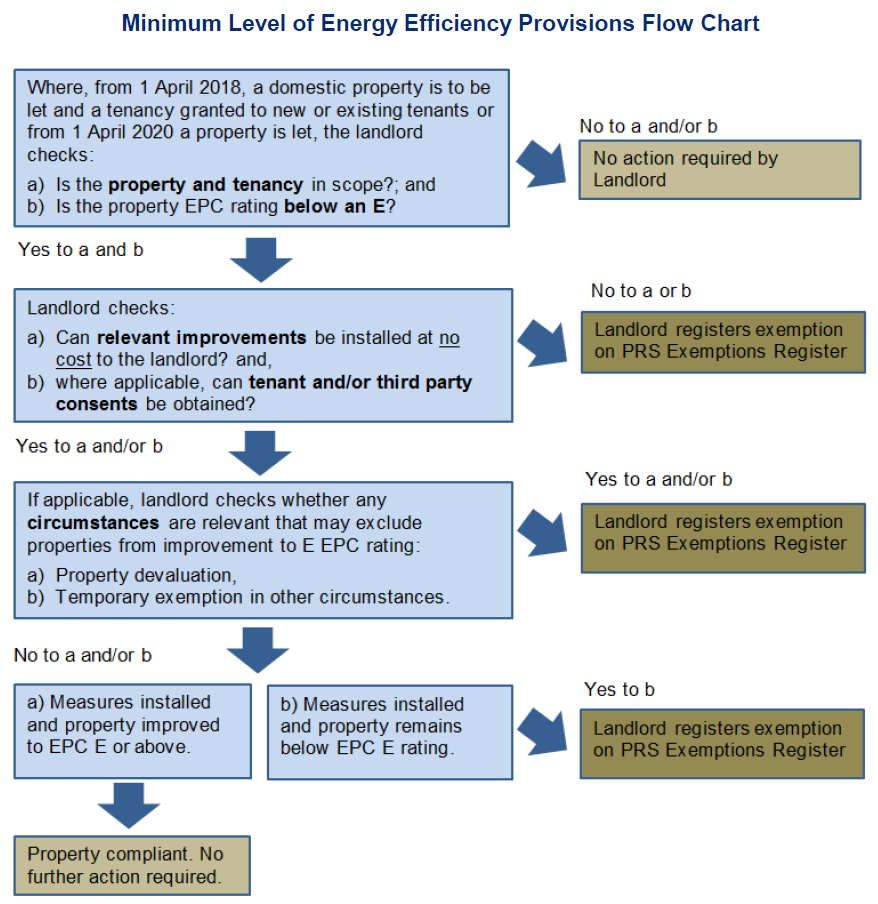

There are a number of circumstances where an exemption or multiple exemptions from making improvements can be claimed. Where an exemption of this type is claimed, it may be possible to continue to rent out a substandard property. However, all exemptions of this nature must be lodged on the PRS Exemptions Register.

Additionally, it should be noted that specific supporting evidence is required before registering an exemption on the PRS Exemptions Register. We can provide specialist advice in this area as part of our service but would always caution clients that meeting these requirements can cost significantly more than making improvements to meet the MEES. This will obviously depend upon the building and the improvements required but changing a few lights will likely be cheaper than obtaining professional services to prove a property will be devalued for example.

Registered exemptions are also non-transferable. At best they are valid for a maximum of five years but a change in tenant or sale to a new landlord will normally mean the process (and costs involved) will have to be repeated. Only then can new exemptions be registered. There are also significant penalties for making a false or misleading declaration on the PRS Exemptions Register.

The main exemptions from making an improvement are:

- All relevant improvements have been made – Where all the improvements suggested have been made and the property still remains below the MEES.

- Incompatible wall insulation improvements – Where independent experts conclude that it is inappropriate to make the wall insulation improvements suggested as they would have a negative impact on the structure or fabric of the property (or the building of which it is part).

- Improvements which cannot be financed without cost to the landlord – Landlords are not required to make improvements where relevant “no cost” funding is not available. However, they must attempt to take advantage of funding that is available and must be able to demonstrate this. Improvements that do not meet the new “Golden Rule” for Green Deal funding may fall within this exemption but only if alternative funding is not available.

- Devaluation of the property – You are not required to make an improvement where an independent surveyor determines that making it would devalue the property by more then 5% of its current market value.

- Third Party Consent is refused – Where there is a sitting tenant you might complete the formal process required in offering to improve the property and consent may be withheld. Equally, you may require consent from a superior landlord, a bank or building society or the local authority which may be reasonably refused. However, you will have to demonstrate that you have applied for permission and have tried to accommodate any reasonable restrictions that they have placed upon you before you can claim this exemption. This exemption can also be used where planning, conservation or other consents are required from statutory authorities providing it can be demonstrated that these have been applied for and refused.

Please note that every suggested improvement must be considered individually for the purposes of claiming exemptions. It is therefore highly likely that, even where some improvements may be subject to exemptions, others will not. In this situation, some improvements to the building will still need to be made.